By Carolyn Fields, CRMP –

The rising cost of health care is an issue we all struggle with. Fortunately, if you are a homeowner age 62 and older, a reverse mortgage could help you fund these needs! Before I go into greater detail let’s review a few basic points about reverse mortgages.

The rising cost of health care is an issue we all struggle with. Fortunately, if you are a homeowner age 62 and older, a reverse mortgage could help you fund these needs! Before I go into greater detail let’s review a few basic points about reverse mortgages.

Answers to Common Questions about Reverse Mortgages If I obtain a reverse mortgage, will the bank own my home?

No. A reverse mortgage is similar to any other mortgage product in that the bank simply places a lien on your property and has no ownership interest. You always retain title to your home.

Do I have to make monthly mortgage payments?

No. No monthly mortgage payments are required as long as the home remains your primary residence.

Do I have to pay taxes on the money I receive from my reverse mortgage?

No. Simply stated, you do not have to pay taxes on money received from a reverse mortgage.

My credit is poor and income is limited. Can I still get a reverse mortgage?

Yes. For a reverse mortgage, your personal credit rating is irrelevant. As long as you have sufficient equity in the home and are able to pay property taxes, HOA dues, and homeowners insurance you qualify!*

We have been fortunate to have helped a number of clients enjoy a better quality of life with a reverse mortgage. There are two particular instances that we’d like to share:

In the first example, Mrs. Smith’s daughter approached us at a recent workshop and had many questions about reverse mortgages. After a long discussion, her daughter confided that her mother couldn’t care for herself at home alone but definitely wanted to remain in the home that she had spent the past 15 years in. The cost of having a health care aide come in for 20-30 hours per week was about $XXXXX – which was a major burden for Mom and the kids to shoulder on their own.

Fortunately, Mom was able to take out a reverse mortgage and establish a line of credit which she can periodically tap to access funds which gave her the ability to remain in her home and receive the quality health care she needs and deserves.

In another case, Mr. and Mrs. Johnson were trying to make ends meet after the loss of a pension when Mrs. Johnson’s former employer went into bankruptcy. The Johnsons were faced with a mortgage, credit cards, and mounting medical costs that seemed overwhelming. After meeting with them, we were able to assist them in using a fixed-rate reverse mortgage to eliminate their monthly mortgage payments and other bills.

The extra monthly cash flow created by eliminating the mortgage payment and other debt has been life-changing and has given them the financial flexibility to handle other health care expenses!

A reverse mortgage can be a life-changing financial tool that helps with the unanticipated expenses that life throws at us.

To learn more about this versatile product that can help you live a better life, please contact me at (352) 753-0851 or email me at cfields@firstloans.net.

Check Also

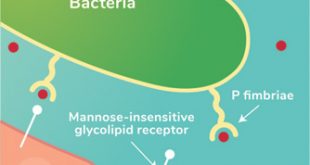

Recurrent UTIs: Addressing the Risk of Antibiotic Resistance

Urinary tract infections (UTIs) are common bacterial infections that affect millions of individuals worldwide each …

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages