By Katina H. Pantazis, Esq.

Dementia is a syndrome that causes deterioration of an individual’s cognitive function. As the baby boomer generation ages, the number of people who are affected by dementia continues to increase. Perhaps the more alarming statistic, the number of dementia cases being diagnosed among individuals in their 50s is also on the rise. Although you may never have to deal with the challenges that a diagnosis of dementia can bring, it is still vital that you complete your estate plan early, while you have the mental capacity legally required to make estate planning decisions.

In order to effectively have a choice in the medical care you will receive, along with the financial decisions that must be made on your behalf, in the event you become mentally incapacitated, you must have a Designation of Health Care Surrogate, Living Will, Durable Power of Attorney, and Declaration of Preneed Guardian prepared by a qualified legal professional.

A Designation of Health Care Surrogate names the individual(s) you would like to make medical decisions for you once you become incapacitated, and provides said individual(s) with HIPPA authorization.

A Living Will describes what type of medical care you would like to receive, and under what circumstances you would like medical care to be stopped, when you are at the end stage of life.

A Durable Power of Attorney names an individual or individuals to serve as attorney-in-fact for you, allowing said individual or individuals to manage those matters affecting your property and possessions. Essentially, your attorney-in-fact has the power to act on your behalf with respect to various transactions. These transactions can be specified based on your individual wants and needs. Being a “Durable” Power of Attorney means that your attorney-in-fact is authorized to continue to act while you are incapacitated (in the event a guardian is not appointed for you).

Now, what happens when someone close to you gets upset that they are not named in your healthcare documents or your power of attorney document? That person may file a petition with the the court asking to be in charge of your financial affairs and healthcare decisions. In this instance, it would be helpful to have a Declaration of Preneed Guardian in place. A Declaration Naming Preneed Guardian nominates an individual to act on your behalf in the event you are in need of a court-appointed guardian. Although it is not binding on the court, by suggesting to the court your preference for a guardian in this manner, your family may avoid some of the administrative burden associated with a court proceeding to determine a guardian.

In preparing to have the above documents created, there are some important things to consider:

1. Where would you like to live and receive treatment? For example, would you like to receive care in your home, or be moved to a specific assisted living facility?

2. Who do you trust to make financial and medical decisions for you?

3. How will you pay for your care?

It is important to note that you must possess adequate mental capacity to create legal documents such as a Designation of Health Care Surrogate, Living Will, Durable Power of Attorney, and Declaration of Preneed Guardian. After a diagnosis of dementia, it may be impossible for you to execute these documents or even amend existing ones.

If you have been deemed incompetent and have not executed a Designation of Health Care Surrogate or Durable Power of Attorney, an individual would have to seek a legal guardianship over you in order to make medical or financial decisions on your behalf.

Below are the legal documents we recommend for everyone to have in place:

. Durable Power of Attorney.

. Designation of Health Care Surrogate.

. Living Will.

. Declaration Naming Preneed Guardian.

Start planning now. Decide who will be in charge of your financial affairs or decisions relating to your health care. Acting now ensures you will have these documents in place long before the need for them arises.

Katina H. Pantazis, Esq.

Katina H. Pantazis, Esq. was born in Augusta, Georgia. She has had the opportunity to live in multiple states: Georgia, Kansas, Mississippi, and Florida. Katina earned a Business degree from Stetson University in DeLand, Florida, in December of 2004. She completed this degree early; knowing that law school was in her future she chose to take a year between college and law school working as a paralegal to gain some hands on experience. This skill set solidified her decision to become an attorney.

Katina earned her Juris Doctorate from Mississippi College School of Law in May of 2009. Law school allowed for many priceless experiences including a study abroad program in Spetses, Greece, where she studied comparative international law. As well as a third year internship with the Middle District of Florida Federal Public Defenders Office located in Tampa. However, the catalyst that landed Katina in the field of law she practices today was receiving the Elder Law Scholarship in her second year of law school. This was the beginning of her journey into estate planning. She immediately fell in love with the work and most importantly the clientele.

Katina has been practicing in Florida for over six years and has practiced as her own firm Katina Pantazis, P.A, for over two years. She practices out of the Villages office and works in estate planning and wealth preservation. Katina considers this her dream job — helping people secure their future, both for themselves and their loved ones.

Katina is also deeply involved in the community. She is a respected member of the Florida Bar, Marion County Bar Association, Lake County Bar Association, Sumter County Bar Association, and Rotary Club of The Villages. She also serves on the board of the Arnette House in Ocala, Florida and still active with her Sorority, Pi Beta Phi. She spends her free time participating in co-ed intramurals including flag football, basketball, soccer and volleyball. She also enjoys running, kickboxing, yoga and crossfit.

Areas of Practice:

Estate Planning, Wills and Trusts, Long-Term Care Planning

KP LAW

352-600-2987

www.lawkppa.com

Check Also

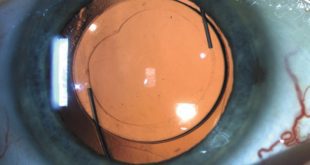

CUSTOMIZABLE LIGHT ADJUSTABLE LENS A GAMECHANGER FOR CATARACTS PATIENTS

All Americans have some degree of cataract change by the age of 75. As the …

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages