By Bruce Hancock

Many people decide to move forward with a reverse mortgage for various reasons; loss of a spouses income, running out of money as costs rise, fix up the home, have money sitting there should you need it someday, or just want to enjoy life a little better. Having access to the equity in your home could be the answer. As our population is living longer, people are searching for viable options to help them live out their best life. So, while the retirement age used to only last a decade, it is now lasting for two or more decades. Also, with this longer life, we can experience and make many more memories, but along with this merriment, longevity of life often comes with significant health issues.

Many people decide to move forward with a reverse mortgage for various reasons; loss of a spouses income, running out of money as costs rise, fix up the home, have money sitting there should you need it someday, or just want to enjoy life a little better. Having access to the equity in your home could be the answer. As our population is living longer, people are searching for viable options to help them live out their best life. So, while the retirement age used to only last a decade, it is now lasting for two or more decades. Also, with this longer life, we can experience and make many more memories, but along with this merriment, longevity of life often comes with significant health issues.

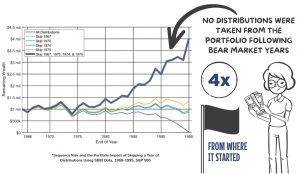

It’s a common misconception to view a reverse mortgage as looming financial woe. Reverse mortgages are not to be looked at as a last resort to economic difficulty, but rather as an opportunity to build proceeds and profit for your retirement and perhaps your mounting healthcare bills.

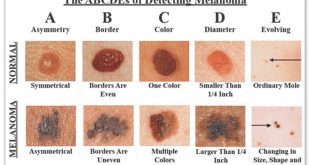

In addition to costly matters such as emergency funds, home maintenance, travel and leisure, the healthcare industry is expensive. If you are diagnosed with cancer, your office visits, surgery, and treatment will be ongoing, and your cost associated with your care will be continuously escalating. The same holds true for many other age-related diseases and disorders.

Total projected lifetime health care premiums (Medicare Parts B and D, supplemental insurance, and dental insurance) for a healthy 65-year-old couple can be around $400,000. Adding deductibles, copays, hearing, vision, and dental cost sharing, that number grows exponentially.

In cases where medical care is a major issue, reverse mortgages are helping countless individuals maintain their lifestyle of choice while receiving quality restorative treatment. With today’s modern reverse mortgages, you remain in control, and the terms are more flexible than those of the past. As an example, you always own your home, you have a guarantee that you can never owe more than its’ value.

You will remain the owner of your home’s title throughout the entire reverse mortgage process. You are able to leave your home to family members, and your loved ones can even remain in the home if you were to pass away.

FHA Insured Reverse Mortgages

The Home Equity Conversion Mortgage (HECM) is an FHA insured reverse mortgage and is the safest and most popular type of reverse mortgage on the market. HECM’s are the only reverse mortgage insured by the federal government through the Federal Housing Administration (FHA), a division of the Department of Housing and Urban Development (HUD).

The HECM allows homeowners, ages 62 and better, to convert part of their home equity into tax-free proceeds. *There is never a required monthly mortgage payment on a HECM, and there is no pre-payment penalty if the consumer ever chooses to pay the loan back in part or in full. Repayment of the loan can never exceed the home’s value and the heir’s will never inherit a debt. The homeowner must maintain the property and pay property taxes, homeowner’s insurance, and any HOA fees. The home must be the borrower’s primary residence.

Bruce Hancock, Reverse Mortgage Expert

Bruce Hancock is a reverse mortgage specialist working for Mutual of Omaha. He has been in the mortgage industry since 1984 and along with his highly sought-after mortgage expertise, Bruce takes great pride in helping seniors retire comfortably with better options. He has always been conscientious and dedicated to being the best, which is why he always listed as a top producer throughout his career.

To find out more details, contact Bruce Hancock today.

Mutual of Omaha

Serving The Villages & Central Florida

Reverse Mortgage Specialist

NMLS# 90211

Office: 352-633-3204

Mobile: 609-617-5723

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages