By North Star Wealth Advisors

When our clients come to us to discuss retirement we often hear – “I want to retire, but I am not sure whether I can, or if I should.” We also hear, “I want to retire but retire to what?”

When our clients come to us to discuss retirement we often hear – “I want to retire, but I am not sure whether I can, or if I should.” We also hear, “I want to retire but retire to what?”

Are you ready to move into retirement or on to the next chapter of your life, but are uncertain if you can or should? Are you concerned about what lies ahead?

Preparing for retirement can be a challenge in today’s fast-paced, and self-service world. Have you noticed that the changes and choices that affect our lives have grown over the past few years? Sometimes they can be overwhelming. This is especially true in the world of finance.

You may have a very idealistic vision of retirement — doing all of the things that you never seem to have time to do now. But how do you pursue that vision? Social Security may be around when you retire, but the benefits that you get from Uncle Sam may not provide enough income for your retirement years. To make matters worse, few employers today offer a traditional company pension plan that guarantees you a specific income at retirement. On top of that, people are living longer and must find ways to fund those additional years of retirement. Such eye-opening facts mean that today, sound retirement planning is critical.

But there’s good news: Retirement planning is easier than it used to be, thanks to the many tools and resources available. Here are some basic steps to get you started.

Develop Your Personal Balance Sheet

Gather information about your assets and your liabilities to develop a detailed personal balance sheet. This will help you see what you own and what you owe. Some assets may over time be used to produce income to fund your “ideal retirement.”

Develop Your Cash Flow Statement & Determine Your Retirement Income Needs

It’s common to discuss desired annual retirement income as a percentage of your current income. Depending on whom you’re talking to, that percentage could be anywhere from 60% to 90%, or even more. The appeal of this approach lies in its simplicity. The problem, however, is that it doesn’t account for your specific situation. To determine your specific needs, you may want to estimate your annual retirement expenses.

Keep in mind that your annual expenses may fluctuate throughout retirement. For instance, health-

related expenses may increase in your later retirement years. A realistic estimate of your expenses will tell you about how much yearly income you’ll need to live comfortably. Remember to take inflation into account.

Determine Your Retirement Income Sources

Utilize this step to develop your personal cash flow statement that illustrates your current income and your current expenses. This is helpful in projecting future income sources to fund your Ideal Retirement. These can include social security, pensions and other forms of income such as annuities.

Any shortfall will need to be filled from your savings and investment plans, including your qualified plans such as IRAs and 401ks.

We believe there is no single solution to generating income or cash flow for retirement. There are various ways to obtain reliable income while keeping risk in check. The nice thing about most methods is they can be mixed and matched to suit your personal needs.

Next, we will move on to Tax Planning as taxes play a big role in many people’s retirement, especially when you start to take your Required Minimum Distributions from your retirement accounts.

Tax Planning

Taxes play a role in many people’s income plans for retirement. A review of your current tax situation, as well as a projected look at your future taxes, is often challenging. We try to tell clients that they have a partner in their Retirement Plans, that is the federal government, and they get to determine what share they will get. Taking a projected look at this may help in the client’s current decision making.

There are many other items that you may need to consider in your preparation for retirement or just moving on to the next chapter of your life. One that is often overlooked is the development of a legacy plan, one that passes your assets on to your heirs in a tax efficient manner.

Understand Your Investment Options

This is one area that many people find difficult in retirement, as each investor is unique. It is best to understand the types of investments that are available and decide which ones are right for you. We do not recommend utilizing a “one size fits all, cookie-cutter approach” to investing. If you don’t have the time, energy, or inclination to do this yourself, hire a financial professional. He or she will explain the options that are available to you and will assist you in selecting investments that are appropriate for your goals, risk tolerance, and time horizon. Note that many investments may involve the risk of loss of principal.

North Star Wealth Advisors Offers

A Complimentary Initial Consultation.

Contact us at 813-793-7048 dominick@northstarwealthadvisor.com

Information in this article is not intended to constitute legal, tax, accounting, or investment advice, nor an opinion regarding the appropriateness of any investment, nor a solicitation of any kind.

Securities and advisory services are offered through Calton & Associates, Inc. Member FINRE/SIPC. North Star Wealth Advisors and Calton & Associates are separate entities.

Check Also

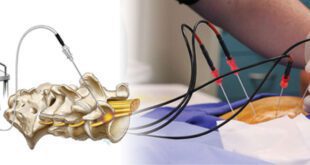

Breaking Through the Pain: How the Stealth Laser is Revolutionizing Nerve Pain Treatment

Nerve pain, or neuropathic pain, is one of the most challenging conditions to treat in …

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages