The most important piece of advice I can give members of the motoring public is to purchase uninsured motorist coverage if you have not already done so!

The most important piece of advice I can give members of the motoring public is to purchase uninsured motorist coverage if you have not already done so!

Florida law requires hardly any automobile insurance. All that is required is $10,000 of Personal Injury Protection (P.I.P.) coverage and $10,000 of Property Damage Liability coverage. P.I.P. coverage is available to pay 80% of medical bills related to a collision and 60% of provable lost income related to a collision, up to a combined limit of $10,000, (assuming you obtain treatment within 14 days of the collision!). P.I.P. coverage does not cover any pain and suffering or other intangible (non-economic) damages. As those who have been injured in an auto collision know, an emergency room bill alone can be more than $10,000.

Property Damage Liability coverage covers property damage which you caused. It has nothing to do with any personal injury.

Since Florida law does not require any Bodily Injury Liability coverage, many people driving on the roads of Florida have no Bodily Injury Liability coverage which means that if such a person injures you, that person has no insurance to cover your bodily injuries. My guess is that between 25 and 50% of people driving in Florida have no Bodily Injury Liability coverage.

Therefore, if you want to be compensated for injuries caused by an uninsured motorist, you absolutely need Uninsured Motorist coverage. Uninsured Motorist coverage is available for your injuries caused by an uninsured motorist. (If the at-fault party has some Bodily Injury Liability coverage, and your injuries have a value in excess of that amount of coverage, your Uninsured Motorist coverage is called Underinsured Motorist coverage because the at-fault motorist is, in that situation, underinsured, rather than totally uninsured.)

Uninsured/Underinsured Motorist coverage is coverage in excess of any Bodily Injury Liability coverage which the at-fault party has. In other words, it covers your injuries which have a value in excess of the amount of the at-fault party’s Bodily Injury Liability coverage.

Bodily Injury Liability coverage and Uninsured/Underinsured Motorist coverage are available for any medical bills and lost income not covered by P.I.P. coverage, but more importantly, both coverages are available to pay for intangible (non-economic damages) such as pain and suffering, disability or physical impairment, disfigurement, mental anguish, inconvenience, loss of the capacity for the enjoyment of life, experienced in the past or to be experienced in the future. Both tangible (economic) and these intangible (non-economic) damages are recognized by Florida law as being compensable.

Motorcycle drivers and riders need Uninsured/Underinsured Motorist coverage more than any other category of Florida motorists. The obvious reason for that fact is that motorcycle drivers and riders are vulnerable to being injured severely by other drivers who sometime do not see the motorcycle. And, of course, the human body is not made to impact hard objects at sometimes high speed.

The fact that you may have health insurance does not mean you do not need Uninsured/Underinsured Motorist coverage. Health insurance pays some of the medical bills. It does not cover the intangible (non-economic) damages listed above. Also, health insurance is often limited in the amount of medical bills it will pay.

I hope this article prompts you to check your auto insurance policy or policies to see whether they included optional Uninsured/Underinsured Motorist coverage. If such coverage is not included, you should call or see your insurance agent immediately and add Uninsured/Underinsured Motorist coverage for each of the vehicles you own.

I recommend buying stackable Uninsured/Underinsured Motorist coverage. Stackable means that if you have paid a premium for Uninsured/Under-

insured Motorist insurance coverage for each vehicle you own, that coverage will be multiplied by the number of vehicles you own and you will have that combined total amount of Uninsured/Underinsured Motorist coverage in case you need it for injuries caused by a negligent uninsured/underinsured motorist.

Of course, the coverage you have in effect at the time of the collision is the coverage that is available to you. You cannot get injured and then purchase coverage to cover your injuries.

Uninsured/Underinsured Motorist coverage is not well understood by the general public, and, sometimes such claims are wrongfully denied by insurance companies. This article just scratches the surface of the law regarding such coverage. If you are injured and have any question as to whether your Uninsured/Underinsured Motorist coverage (or that of a resident relative) is available to you for your injuries, please feel to call John or his daughter and law partner, Katie Glynn, for a free office consultation, (352) 351-5446, at 320 NW Third Avenue, Ocala, FL 34475, since 1981.

ocalapersonalInjury.law

320 NW 3rd Ave., Ocala, Florida 34475

Check Also

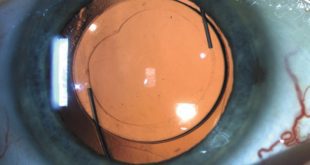

CUSTOMIZABLE LIGHT ADJUSTABLE LENS A GAMECHANGER FOR CATARACTS PATIENTS

All Americans have some degree of cataract change by the age of 75. As the …

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages