By Teresa K. Bowman, Of Counsel

As we enter December, most of us begin thinking about giving gifts to those we love. Although retail stores have bombarded us with holiday decorations since October, once December rolls around it’s time to get serious. Once they reach a certain age, many of my clients begin to realize they’re not likely to outlive their money and want to take advantage of the annual exclusion allowed by the IRS and gift cash to their adult children. Whether to an adult child who is entering a different phase of life such as starting a new career or opening a business, or to a grandchild entering graduate school or buying their first home, cash gifting is a frequent topic of conversation with clients as we head into the year’s end.

As we enter December, most of us begin thinking about giving gifts to those we love. Although retail stores have bombarded us with holiday decorations since October, once December rolls around it’s time to get serious. Once they reach a certain age, many of my clients begin to realize they’re not likely to outlive their money and want to take advantage of the annual exclusion allowed by the IRS and gift cash to their adult children. Whether to an adult child who is entering a different phase of life such as starting a new career or opening a business, or to a grandchild entering graduate school or buying their first home, cash gifting is a frequent topic of conversation with clients as we head into the year’s end.

This article will address some of the common questions I get concerning cash gifting to adult children or grandchildren.

1. How much can I give without paying taxes?

The IRS sets a limit called the annual exclusion that lets you gift up to the limit without having to worry about filing a gift tax return. For 2019 that amount is $15,000 per gift, to as many people as you like. So, you could give your two children $15,000 each, and your two grandchildren $15,000 each, for a total gift of $60,000 and no gift tax return would need to be filed.

2. What if I go over the annual exclusion amount?

If you gift more than $15,000 to any one person, you will need to file a gift tax return. For example, say you give your granddaughter $5000 as a wedding gift, and then give her $15,000 when you make the annual gift. You have exceeded the $15,000 limit to her, so you would need to file a gift tax return for the $5000 in excess of the limit. However, unless you have exceeded your maximum lifetime gift amount of $11.4 million, you won’t pay a gift tax.

3. Can both my spouse and I make a gift?

Yes. You and your spouse can each gift $15,000 to each child and grandchild. The gift tax exclusion applies to each gift-giver independently, and everyone has their own lifetime limit of $11.4 million before they have to pay a gift tax.

4. If the IRS says I can gift without penalty, why isn’t it okay with Medicaid?

Although you would think the IRS and Medicaid would be on the same page, unfortunately they’re not. Any gifts made without full consideration (getting something of equal value in return) are considered penalizing gifts under Medicaid rules, with a few exceptions.

5. Do all gifts create a penalty if I need Medicaid?

No. Only gifts made “with the intent to qualify for Medicaid” are penalized. For example, if you give a child money to pay for medical expenses or to help with a down payment on a home only to get a diagnosis of dementia a few years later, it is easy to document that the gift was not made with an intent to qualify for Medicaid. And some gifts are allowable under Medicaid rules. For example, you can gift to your spouse or to a blind or disabled child without penalty. Regardless, it’s still a good idea to seek legal counsel if you are considering gifting and have a concern about Medicaid entering the picture within 5 years.

6. How does the VA look at gifts if I apply for Aid and Attendance?

The VA also has a look-back period for gifting. While Medicaid looks back 5 years for any penalizing transfers, the VA looks back 3. Unlike Medicaid, the VA penalizes you only if your gift would have reduced your assets to below the asset limit. For example, the VA asset limit is currently $127, 061. If you have $125,000 in assets and gift $30,000, under VA rules there is no penalty because you were already below the asset limit. Not so with Medicaid, and the $30,000 gift would still be a penalizing gift under the rules.

7. What if I gift the money to my kids and I end up needing it?

Ah, I get this question a lot. I advise my clients that if they have worries, they should consider gifting into an asset protection trust. Properly drafted, this type of trust would allow the assets to be gifted but maintained during the lifetime of the giver (the grantor), with limitations on who can take withdraws prior to their death. Again, if considering gifting using an asset protection trust, seek out your elder law attorney to find out if this would work for you, and if you’re comfortable giving up control of a portion of your assets while you’re alive.

8. If I don’t gift during my lifetime, will my kids pay inheritance taxes?

No, your children won’t pay inheritance taxes, but if your estate exceeds the federal estate tax limit of $11.4 million, there will be an estate tax return to file. Any taxes due would be paid from your estate before distributions are made to your beneficiaries.

If you are considering making cash gifts to your family, it may be a good time to sit down with your elder law attorney and discuss options. Better to know now how gifting could affect you in the future should you need long term care and want to qualify for a state or federal benefit.

McLin Burnsed Attorneys at Law

1028 Lake Sumter Landing, The Villages, FL 32162

352-259-5011 | www.McLinBurnsed.com

Check Also

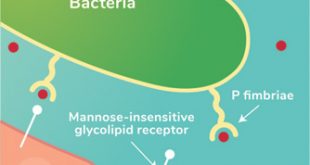

Recurrent UTIs: Addressing the Risk of Antibiotic Resistance

Urinary tract infections (UTIs) are common bacterial infections that affect millions of individuals worldwide each …

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages

Central Florida Health and Wellness Magazine Health and Wellness Articles of the Villages